Consumer brands seek to establish direct relations with end customers for a range of reasons: to generate deeper insights about consumer needs, to maintain control over their brand experience, and to differentiate their proposition to consumers. Increasingly, they also do it to drive sales.

While some brands have considered establishing a direct-to-consumer (DTC) channel in the past, they’ve often decided against it. However, now is the time to reconsider as Covid-19 has accelerated profound business trends, including the massive consumer shift to digital channels. Many companies have already been active in launching new DTC programs during the pandemic. For example, PepsiCo and Kraft Heinz have both launched new DTC propositions in recent months. Nike’s digital sales grew by 36 percent in the first quarter of 2020, and Nike is aiming to grow the share of its DTC sales from 30 percent today to 50 percent in the near future.

But, for the vast majority of consumer brands that are used to selling through intermediaries – including retailers, online marketplaces, and specialised distributors – their experience with direct consumer relationships and eCommerce is limited. As a result, they often hesitate to launch an e-commerce channel despite the obvious opportunity it offers.

Nevertheless, having a deliberate strategy that clearly qualifies the opportunity and an execution capability to effectively convert customers at a reasonable cost, consumer companies can overcome these concerns and set up a profitable new source of growth.

Making the economics work

For eCommerce to be a profit centre rather than a loss leader, companies need to manage the economics of DTC effectively across revenue and cost.

Revenues

DTC channel role: Start by defining the role DTC should play for the brand. Nike, for example, invests in DTC as a way to further establish its brand. As the number of its third-party distribution partners grew over the years, the brand risked being diluted because of inconsistent consumer experiences. In 2020, Nike reported that one-third of its global sales were completed through Nike Direct.

Assortment: Many brands choose to adapt their DTC assortment to the specific requirements of their sector and consumers. The new web shops PepsiCo and Kraft Heinz launched this year offer only large items or bundles. This is to ensure that basket sizes are large enough to offset shipment costs, to avoid conflicts with other channels, and to provide convenience to those customers who prefer to buy certain items in bulk.

Prices: As a general rule, online prices should be on par with retail prices. But premiums can be justified by offering additional benefits, such as free delivery and returns, exclusive merchandise, or product personalisation. Some players have devised unique online pricing schemes to drive frequency and total spend per year, especially in categories with high repeat-purchase potential. For example, Gillette encourages shoppers to subscribe to razor-blade delivery by offering the first kit for free.

Cost

Best-practice companies manage all elements of the online shopper journey to keep the costs of DTC in check.

Prepurchase: Marketing cost can be optimised by making the most of both paid and owned media investments, such as your own social media channels and outbound customer relationship management (CRM).

Delivery: Partnership fees, such as referral fees, are a key driver of supply-chain cost. Large corporations will want to establish frame contracts with logistics providers for all their brands. Lighter product packaging for the online assortment and flexible shipping options, such as click and collect or delivery to partner retailers, can help keep shipping costs down.

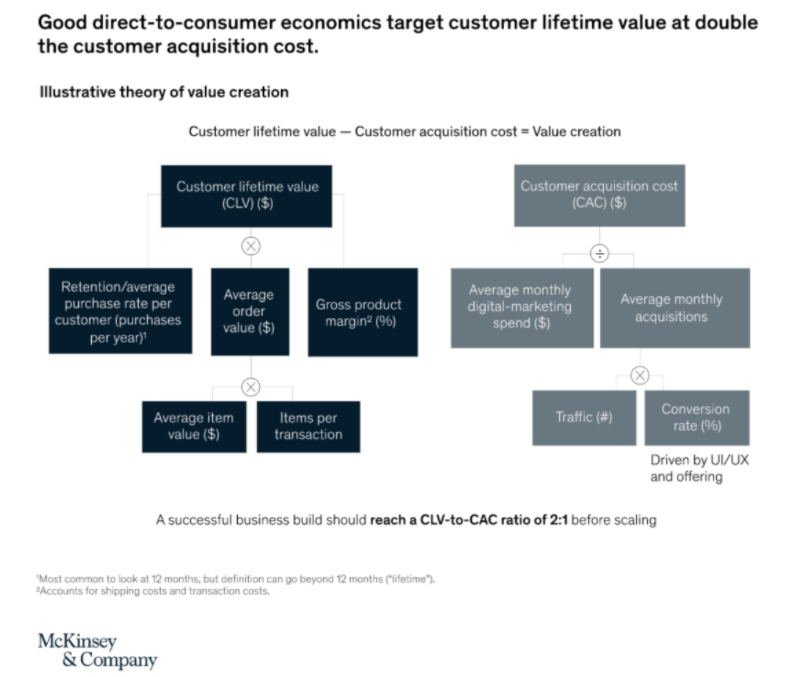

Postpurchase: Acquiring a new customer can be up to five times as costly as retaining an existing customer. This is why managing customer lifetime value (CLV) is crucial to DTC profitability. As a general rule, the DTC business model is viable when the CLV is twice as much as the CAC prior to rollout at scale.

Getting started

There are multiple ways to begin the DTC journey. For brands just starting with eCommerce, using online marketplaces and established apps can be effective ways to learn about what works well online. Other brands that are more digitally mature may want to scale their online presence to engage consumers and generate insights on what works well but hold off on launching eCommerce.

However, before investing in technology or hiring an agency to build the web shop, companies need to ask the following questions:

- What is the role of DTC in the channel strategy? Will it help drive sales? Generate insights? Combat churn and stabilize market share? It is important to force clarity and assess relevant trade-offs, such as linkages to other channels and existing channel partners

- What is the assortment and pricing strategy? DTC requires a clear view of assortment and pricing as part of a broader channel strategy

- How will you build up the necessary capabilities? Brands don’t have to do all the heavy lifting alone, but they will need to weigh the trade-offs of buying, building, and partnering extensively

But with shopper behaviour changing so quickly, brands will need to move with urgency to answer the critical questions and determine how best to connect with their customers online.

Photo by Stephan Henning on Unsplash

Interested in hearing leading global brands discuss subjects like this in person?

Find out more about Digital Marketing World Forum (#DMWF) Europe, London, North America, and Singapore.

Thank you for this amazing article. It helped me much